GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

![]()

![]()

![]()

- November 10, 2024

-

Mohammed Saqib

Mohammed Saqib

In this article, we’ll discuss financing options and business loans for entrepreneurs and businesses with bad credit profiles. Remember, if you are struggling with high debt, looking into debt relief options may be a smarter idea than getting yet another loan that could sink you deeper into debt.

| Lender Name | Loan Highlights |

|---|---|

| Top Five Banks (RBC, TD, BMO, Scotiabank, CIBC) | Small business loans and lines of credit with lower interest rates, extended repayment terms; strict credit requirements, longer approval times. |

| Merchant Growth | Specializes in merchant cash advances and working capital loans; fast approval and flexible repayment; higher interest rates than traditional banks. Bad credit accepted. |

| Swoop Funding | Provides equipment and asset-based loans, suitable for high loan amounts; fees and terms vary by funding type. Bad credit accepted. |

| LoansCanada.ca | Loan-search platform for businesses with bad credit, offering access to multiple lenders; potential broker fees and variable processing times. |

| MicroCapital.ca | Partners with 35+ lenders, offering tailored solutions like emergency and equipment loans; potential broker fees, variable interest rates. |

| Driven.ca | Digital platform for quick loans for entrepreneurs rejected by banks; short repayment terms and higher interest rates. |

| Journey Capital | Offers equity investments and debt financing for mid-sized businesses; flexible investment terms, more selective criteria. Bad credit accepted. |

| SharpShooter Funding | Small business loans tailored for owners with poor credit; fast approval but higher interest rates. |

The process of beginning and nurturing a small business is a challenging one when bad credit compromises the accessibility of funding. According to TransUnion’s Q4 2023 report, one-third of Canadians have trouble paying their bills in full. This implies that most of them rely on external sources of funds whether for business purposes or otherwise. But to borrow with a bad credit score is usually a challenge for most people. In this article, we will review some financing loan options for small businesses, especially those with bad credit history.

1. Top Five Banks

Although a bad credit score is a barrier, the best option for getting a loan might be to reach your local bank. The most popular banks of Canada that provide small business loans are RBC, TD, BMO, Scotiabank, and CIBC. These banks give small business loans and lines of credit. Large banks provide convenience and accessibility and an array of financial services that may be very advantageous for your business in the long haul.

Pros: Lower interest rates, extended repayment terms, reliable service.

Cons: Strict credit requirements, longer approval times.

2. Merchant Growth

Official Name: Merchant Growth

Website: https://www.merchantgrowth.com/

Phone Number: +1 866-240-3694

Email: clients@merchantgrowth.com

Google Reviews: 4.1/5 stars (100+ reviews)

Trustpilot: 4.8/5 stars (450+ reviews)

BBB Rating: A+

Merchant Growth specializes in serving small businesses with quick access to capital. They offer products such as merchant cash advances and flexible working capital loans. Merchant Growth has built a reputation for being adaptable, with loan amounts that range from $5,000 to $800,000. Their repayment plans are designed to align with a business’s cash flow, making them a viable option for small businesses. To learn more about the company, read the full review here.

Pros: Fast approval process, flexible repayment schedules.

Cons: Higher interest rates compared to traditional banks.

Customer Reviews: Merchant Growth receives overall positive feedback across various review platforms. On Trustpilot, it boasts a strong rating of 4.8/5 from over 450 reviews, with users often praising the quick funding process and ease of application. Google Reviews shows a slightly lower rating of 4.1/5 from over 100 users.

3. Swoop Funding

Official Name: Swoop Funding

Website: https://swoopfunding.com/ca/

Phone Number: 647 946 3001

Email: canada@swoopfunding.com

Google Reviews: 4.9/5 stars (8 reviews)

Trustpilot: 5/5 stars (370+ reviews)

Swoop Funding specializes in the provision of equipment and asset-based financing. They particularly fit well with businesses looking for high loan amounts. Swoop provides a range of financing options including working capital loans, term loans as well as other more specific financing solutions.

Pros: Specializes in equipment and asset-based loans, can provide larger loan amounts.

Cons: Fees and terms may vary based on the type of funding secured.

Customer Reviews: Swoop Funding also enjoys the approval of its customers on various platforms, which shows the firm’s effectiveness in providing funding for businesses. On Trustpilot, Swoop has a 5/5 rating from more than 300 customers who noted its effectiveness, open communication, and helpful assistance throughout the funding process. To learn more about Swoop Funding’s services, read our full comparative review here.

4. LoansCanada.ca

Official Name: LoansCanada

Website: https://loanscanada.ca/

Phone Number: 1 (877) 995-6269

Email: info@loanscanada.ca

Google Reviews: 3.9/5 stars (90+ reviews)

BBB Rating: A+

Loans Canada is a loan-search platform intended for businesses with bad credit ratings. As one of Canada’s largest loan brokers, LoansCanada.ca partners lenders to secure the best financing terms for their clients. Businesses can also opt for LoansCanada to build credit and then apply for loans through formal institutions like banks. To learn more about this lender, read our full review here.

Pros: Access to a wide network of lenders, competitive rate comparisons.

Cons: Broker fees may apply, processing times can vary.

Reviews: LoansCanada.ca garners generally positive feedback across multiple platforms for its extensive lender network and ease of use. The company has a Google Rating of 3.9/5 rating from more than 500 users, who often highlight the efficient service and good customer support. However, some users report occasional delays in the funding process during high-demand periods.

5. MicroCapital.ca

Official Name: MicroCapital

Website: https://www.microcapital.ca/

Phone Number: +1 866-240-3694

Email: bonjour@microcapital.ca

Trustpilot: 4/5 stars (Limited reviews)

MicroCapital.ca is another loan broker that collaborates with over 35 business lenders. They focus on providing tailored funding solutions that match the unique needs of small businesses. The loan options include business emergency loans, business equipment financing, and general small business loans.

Pros: Customized loan matching, access to a pool of lenders.

Cons: Potential broker fees, varying interest rates depending on the lender.

Reviews: MicroCapital.ca is a relatively new loan broker platform, as evidenced by its limited reviews on Trustpilot. However, the limited reviews state that the application process is hassle-free.

6. Driven.ca

Official Name: Driven

Website: https://www.driven.ca/

Phone Number: 1-866-889-9412

Email: customerservice@driven.ca

Trustpilot: 4.6/5 stars (860+ reviews)

Driven.ca specializes in business loans for Canadian entrepreneurs who have been turned down by traditional lenders. Driven is also an all-digital platform. From application to loan processing and approvals, all is done online. The company accepts early payments without imposing severe penalties. Driven’s payback period is commonly just 3-18 months (could be extended to 24 months, depending on the eligibility).

Pros: Fast funding, simple online application.

Cons: Interest rates are typically higher than traditional bank loans.

Reviews: Driven.ca receives favorable reviews for its straightforward business loan offerings, particularly for Canadian entrepreneurs who have faced rejections from traditional lenders. On Trustpilot, it holds a 4.6/5 rating from around 860 reviews, where customers often commend the user-friendly loan process.

7. Journey Capital

Official Name: Journey Capital

Website: https://www.journeycapital.ca/

Phone Number: +1 877-781-0148

Google Reviews: 4.7/5 stars (130+ reviews)

Trustpilot: 4.9/5 stars (93 reviews)

Journey Capital offers financial services focusing on providing equity investments and debt financing solutions to growing companies. We encourage you to read the review of company’s services and offerings compared to Merchant Growth here.

Pros: Flexible investment terms.

Cons: Limited to mid-sized businesses, more selective criteria.

Reviews: Journey Capital has garnered positive feedback across platforms, reflected in its strong rating of 4.7/5 stars from over 130 Google reviews and 4.9/5 stars from 93 Trustpilot reviews. Many reviews highlight the flexible investment terms and the value-added partnerships that have aided companies in scaling effectively.

8. SharpShooter Funding

Official Name: SharpShooter Funding

Website: https://sharpshooterfunding.ca/

Headquarters: Toronto, Ontario, Canada

Phone Number: +1 855-742-7774

Email: funds@ssfunds.ca

Google Reviews: 4.3/5 stars (60 reviews)

SharpShooter Funding offers loans to small business owners with poor credit. They provide flexible and customized credit facilities tailored to small business needs. The loan amount which is provided to small businesses normally falls between $1,000 and $300,000.

Pros: Fast approval, flexible loan offer.

Cons: Interest rates may be higher compared to traditional options.

Reviews: SharpShooter Funding is known for its quick and personalized approach to providing funding for small businesses for people with bad credit. The customers enjoy high quality customer service and more flexible loan terms compared to other lenders.

9. FundThrough

Official Name: FundThrough

Website: https://www.fundthrough.com/

Headquarters: Toronto, Ontario, Canada

Phone Number: +1 800-766-0460

Email: info@fundthrough.com

Google Reviews: 4.6/5 stars (180+ reviews)

FundThrough is an invoice factoring company that provides financing based on outstanding invoices, helping businesses with credit challenges access working capital.

Pros: No credit check required, funding based on invoices.

Cons: Limited to businesses with unpaid invoices.

Reviews: Many small business owners find FundThrough’s invoice-based financing to be a lifeline, especially for bridging gaps in cash flow without a high credit score requirement.

10. Borrowell

Official Name: Borrowell

Website: https://borrowell.com/

Headquarters: Toronto, Ontario, Canada

Email: info@borrowell.com

Google Reviews: 4.4/5 stars (1000+ reviews)

Borrowell focuses on business loans and credit-building products for small businesses and individuals with poor credit histories in Canada. The company provides funding up to $35000.

Pros: Credit-building options.

Cons: Lower loan amounts compared to other lenders.

Reviews: Users praise Borrowell for its credit rebuilding features and ease of application.

Government Resources for Small Business Financing

Here are some Canadian government resources you can explore if you’re looking for financing options for your small business or startup, even with bad credit:

1. Canada Small Business Financing Program (CSBFP)

The CSBFP is one of the most accessible government-backed programs for small business owners in Canada. This program helps businesses obtain loans from financial institutions by sharing the risk with lenders. The loans can be used to purchase equipment, renovate or improve leased properties, and even finance commercial vehicles. The program allows loans of up to $1 million, with a cap of $350,000 for equipment and leasehold improvements.

2. Business Development Bank of Canada (BDC)

The BDC offers flexible financing options for small businesses, including those with less-than-perfect credit. BDC specializes in providing loans that consider business viability and cash flow over credit score alone. They offer a range of solutions from working capital loans to equipment financing and even expansion loans

3. Regional Development Agencies (RDAs)

Canada has various Regional Development Agencies that provide targeted support based on the province or region you operate in. RDAs often have tailored programs that offer financial aid, including grants and low-interest loans. For example:

- Western Economic Diversification Canada (WD) in Western Canada

- Federal Economic Development Agency for Southern Ontario (FedDev Ontario)

- Atlantic Canada Opportunities Agency (ACOA) in Atlantic Canada

- Check Your Local RDA: Regional Development Agencies

4. Canada Job Grant

If you’re planning on using financing to develop and train your staff, the Canada Job Grant offers funding to help cover training costs. While not a direct business loan, this grant can reduce training expenses if you plan to use a loan to grow your business.

5. Canada Emergency Business Account (CEBA)

Though CEBA was primarily launched as a pandemic relief measure, it provides an excellent example of how the government has supported small businesses in challenging times. The program offers interest-free loans and partial loan forgiveness if certain repayment criteria are met. Although new applications are closed, it’s still a good reference for understanding how the government supports small businesses during tough periods.

These resources offer various types of support to small business owners, even if you’re facing bad credit. Exploring these programs can help you find the right mix of loans and support for your business goals.

Final Thoughts

It may not be easy to find small business financing with bad credit, however there are many Canadian lenders and brokers to address this need. Whether you’re looking for a more conventional bank loan with slightly lower rates or more freedom with companies such as Merchant Growth or Swoop Funding, it is critical to know the benefits and drawbacks of each option. It’s important to always check each lender’s terms to make the best choice for your business financing needs.

Struggling with debt? Avoid more loans.

If you are already under heavy debt, you can potentially lower it by 30%-50% with a debt relief agency like Consolidated Credit Canada.

Saqib is a Canadian business writer that holds a Master’s degree from Wilfrid Laurier University in Ottawa. He brings a strong foundation in business, accounting and finance to his work. He began his career three years ago as an investment analyst at a well-known financial firm, focusing on analyzing publicly-listed companies. Saqib employs fundamental analysis as a core part of his approach and has been featured in publications like Seeking Alpha, InvestorPlace, and Yahoo! Finance.

RECENT POSTS

- Top 11 Canadian Business Bank Accounts (Comparing Fees & Reviews)

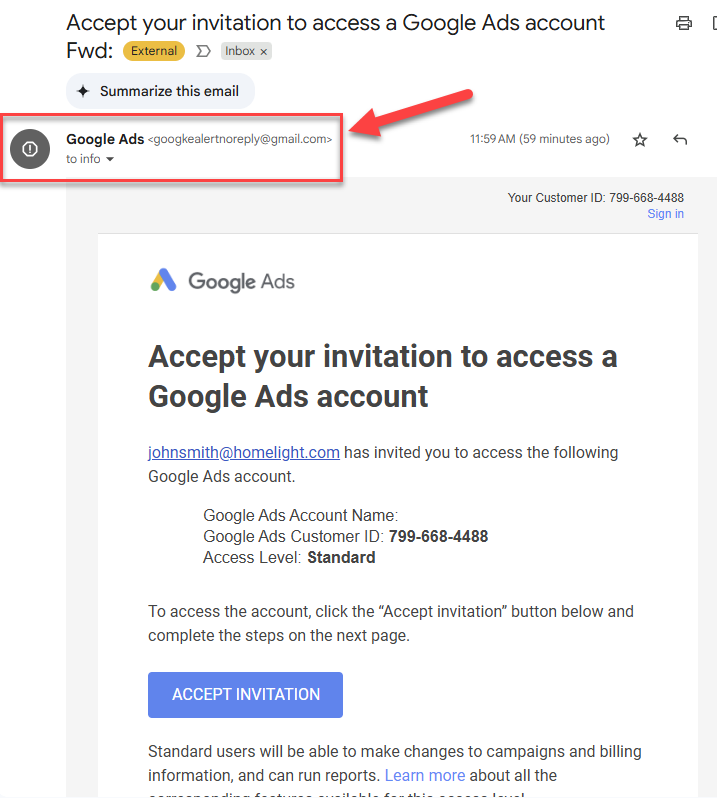

- SCAM ALERT: How a Fake Google Ads Inquiry Nearly Got Us (And How to Protect Yourself)

- Google My Business: 9 Tips to Ensure Your GMB profile Stands Out in the Map Pack

- 8 Outdated Logo Design Trends That Are Making Your Business Look Bad

- How We the North Became the Toronto Raptors’ Rallying Cry

Ready to chat about how Little Dragon Media can enhance your business?

Call us now at 647-348-4995 or

OUR AWARDS & CERTIFICATIONS

WHAT OUR CLIENTS ARE SAYING

Little Dragon Media's professionalism and commitment to delivering excellence are truly commendable. I highly recommend their services... Thank you for your stellar work!

- Delna Bharucha

Little Dragon Media worked on developing our logo and website. They did an absolutely AMAZING job on both projects. These guys ROCK and you won't be disappointed.

- Sonia Nutt

My team had a great experience working with Little Dragon Media. We will certainly engage with Little Dragon Media for any additional projects in the future. Highly recommend!

- Carly Rooney

- 682A St-Clair West Toronto, ON M6C 1B1

- (647)-348-4995

- info@littledragon.ca

MOST POPULAR SERVICES

RECENT POSTS

GET MORE CLIENTS

Don't let your competitors take over. We'll help you climb to the top and get more clients.

- 682A St-Clair West Toronto, ON M6C1B1

- (647)-348-4995

- info@littledragon.ca

MOST POPULAR SERVICES

RECENT POSTS

GET MORE CLIENTS

Don't let your competitors take over. We'll help you climb to the top and get more clients.

Contact | Press Mentions | Privacy Policy | Terms of Service

© 2024 Little Dragon Media. All Rights Reserved.

Pingback: Best Credit Loan Options Tailored Solutions for Bad Credit