GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

![]()

![]()

![]()

- April 3, 2020

-

Sarah Bauder

Sarah Bauder

Around the world, countries are contending with the multitudinous effects of the global COVID-19 pandemic. Indeed, the full breadth of the ramifications of the coronavirus crisis is yet indeterminate. Unprecedented measures have been taken all in an attempt to curtail the spread of the outbreak. However, the pandemic will eventually come to an end, and blessedly we will begin to return to a semblance of normalcy. In order to truly flourish, the businesses operating in the industry must think about things such as insurance firm website design and marketing services. In this article, we discuss 4 tips for insurance firms to thrive in a post Coronavirus landscape.

Separate Your Insurance Firm From The Competition With An Outstanding Website

Once the Coronavirus crisis blessedly subsides, insurance firms must distinguish themselves from the competition with outstanding website design. A recent survey revealed that an astounding 63% of Canadians admitted they will not buy from a company that has a poorly designed website. Suffice it to say, that statistic ought to give any business owner pause, especially those who own insurance firms, which is already a crowded marketplace.

To thrive in a post Coronavirus landscape, now more than ever insurance firms must make an impactful first impression will an exceptional professionally designed website. Your firm will convey a professionalism that is integral to attracting potential clients, instill a sense of trustworthiness, and garner brand credibility.

Marketing Services For Insurance Firms Will Be Key

In a post Coronavirus landscape, for an insurance firm to truly flourish, marketing services such as effective social media management and marketing will be key to future growth and success. Social media has revolutionized how small businesses like insurance firms are able to reach innumerable potential clients via numerous social platforms.

Insurance firms should understand how imperative building one’s brand is for future success. By increasing your social media presence, you will build brand awareness and demand online, engage your audience, and attract potential clients, giving you an advantage over the competition.

Effective And Proven SEO Services Will Be Essential For Insurance Firms

Undeniably, the COVID-19 pandemic will end, and things will gradually return to normal. People will inevitably be searching for potential insurance providers – that too is a given. To truly flourish in a post Coronavirus landscape, insurance firms will need to consider using effective professional SEO services. By using effective and proven SEO strategies, you will drive organic traffic to your insurance firm’s website, and maximize your ROI.

Proven and effective SEO tips for an insurance firm include things like optimizing your website for SEO, long-tail keyword research, and utilizing and optimizing Google My Business to get excellent customer reviews. Effective SEO will be imperative for insurance firms in Toronto to thrive and grow.

How The COVID-19 Economic Response Plan Pertains To Insurance Firms

The global COVID-19 pandemic is a fluid situation, which fluctuates daily. In an attempt to curtail the spread of the virus, the government of Ontario declared a state of emergency and mandated the closure of all non-essential workplaces in the province. Both the federal and provincial government have deemed insurance to be an essential service. However, it is important to understand what relief measures have been implemented by the federal government in the COVID-19 Economic Response Plan. Amongst the measures providing economic support to Canadians affected by the pandemic is the Canada Emergency Response Benefit (CERB):

“The federal government will provide a taxable benefit of $2,000 a month for up to 4 months to:

- workers who must stop working due to COVID19 and do not have access to paid leave or other income support.

- workers who are sick, quarantined, or taking care of someone who is sick with COVID-19.

- working parents who must stay home without pay to care for children that are sick or need additional care because of school and daycare closures.

- workers who still have their employment but are not being paid because there is currently not sufficient work and their employer has asked them not to come to work.

- wage earners and self-employed individuals, including contract workers, who would not otherwise be eligible for Employment Insurance.”

On April 2, the Insurance Brokers Association of Ontario highlighted the latest updates, in addition to outlining the business support provided through the Canadian Emergency Wage Subsidy:

“Today the federal government announced their list of essential services. As with Ontario’s list, insurance was classified as an essential service, which you can find under the Finance section.

Yesterday the government shared further updates on the business wage subsidy and personal response benefit. At this point, they haven’t stated whether they need insurance companies to deny a business interruption claim in order to be eligible to access benefits.

Canadian Emergency Wage Subsidy (CEWS) – Business Support

- Based on revenues—need to see 30% decrease from the same time last year

- Up to $847/per week per employee—75% on the first $58,900 of salary

- Must reapply each month • Includes hospitality (restaurants and bars), non-profits and charities

- Employers must attest they’re doing everything they can to pay the remaining 25%

- Can apply online through a CRA portal that will launch in 3-6 weeks

- Morneau wants businesses to be ready to rehire people quickly

- $71 billion devoted to wage subsidy

- Companies that may not meet the above requirements may still qualify for the originally announced 10% wage subsidy to be paid from March 18 to June 20 up to a maximum subsidy of $1,375 per employee and $25,000 per employer Canada Emergency Response Benefit (CERB) – Personal Support

- Applications launch on April 6th on a rolling basis based on birthdays; if you’re born in the first quarter of the year you apply on the 6th, second quarter on the 7th, etc.

- If you’ve already applied to EI, you don’t need to apply for CERB; only apply for CERB if you’re ineligible for EI and haven’t applied already

- Funds to be delivered in 3-5 days for direct deposit, 10 days by mail

- Need to confirm after every month that you’re not employed.”

Bill Morneau, Federal finance minister, explained the reasoning for the introduction of the Canadian Emergency Wage Subsidy (CEWS).

“Businesses provide the jobs, the goods and the services that Canadians depend on to keep their communities going, in good times and bad. With the Canada Emergency Wage Subsidy, we are helping businesses keep their staff on payroll so that businesses will be better positioned to rebound when the current challenges have passed. We will continue to do whatever it takes to ensure that workers and businesses are supported through the outbreak, and that our economy remains resilient during these difficult times,” Morneau explained in a press release.

The planet is in the midst of truly unprecedented times with the global COVID-19 pandemic. During this challenging period, it may seem difficult to see an end in sight – a light at the end of the tunnel, as it were. However, the outbreak will inevitably dissipate and this crisis will come to an end. In the interim, stay safe, stay well, stay connected to family, friends, and neighbours, and remember to be kind. Collectively, we will prevail.

Sarah Bauder is a senior content specialist at Little Dragon Media. Sarah has a degree in journalism and has a decade of experience writing content at numerous renowned publications. She enjoys writing about digital marketing, business, entrepreneurship and more.

RECENT POSTS

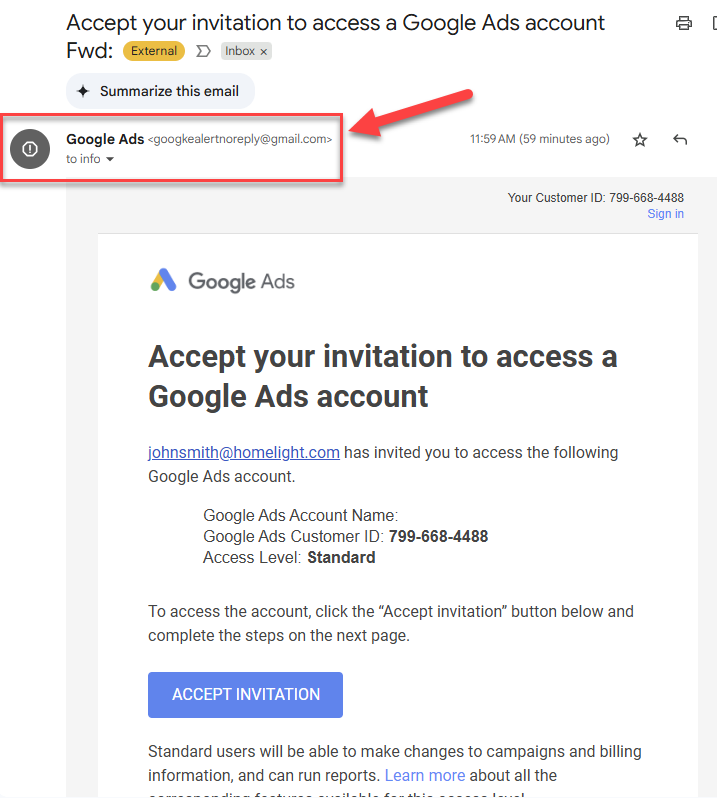

- SCAM ALERT: How a Fake Google Ads Inquiry Nearly Got Us (And How to Protect Yourself)

- Google My Business: 9 Tips to Ensure Your GMB profile Stands Out in the Map Pack

- 8 Outdated Logo Design Trends That Are Making Your Business Look Bad

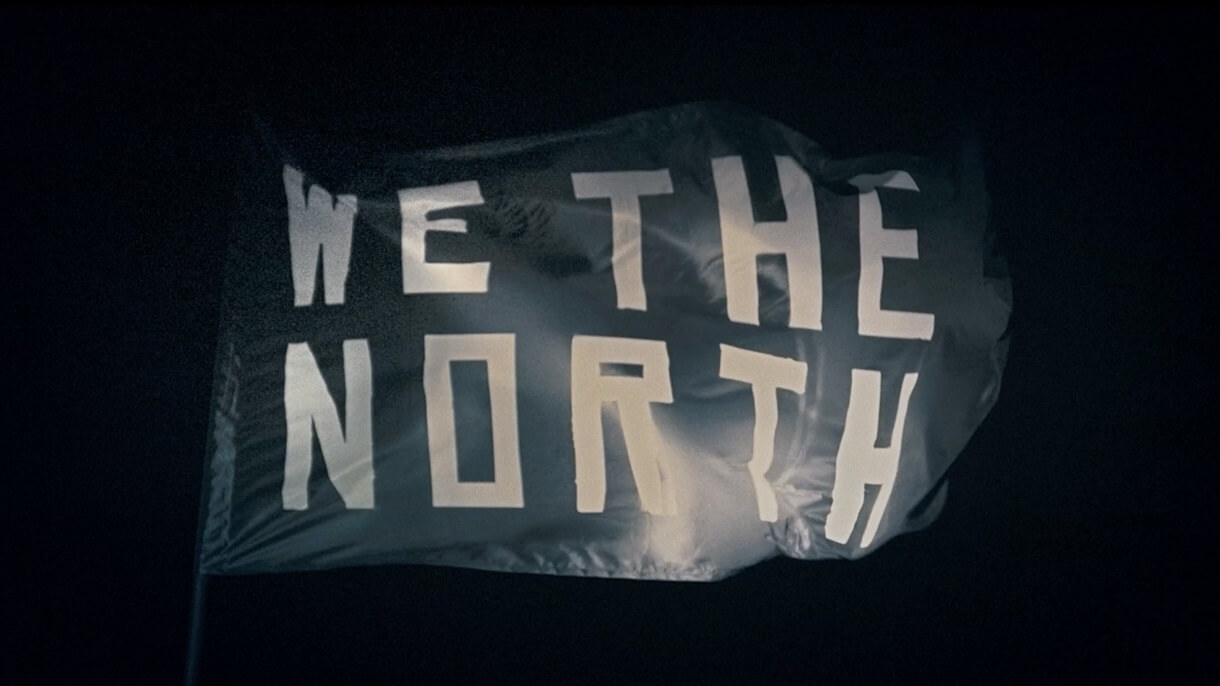

- How We the North Became the Toronto Raptors’ Rallying Cry

- Is A Dedicated IP For SEO A Myth Or Reality? – 13 Experts Weigh In

Ready to chat about how Little Dragon Media can enhance your business?

Call us now at 647-348-4995 or

OUR AWARDS & CERTIFICATIONS

WHAT OUR CLIENTS ARE SAYING

Little Dragon Media's professionalism and commitment to delivering excellence are truly commendable. I highly recommend their services... Thank you for your stellar work!

- Delna Bharucha

Little Dragon Media worked on developing our logo and website. They did an absolutely AMAZING job on both projects. These guys ROCK and you won't be disappointed.

- Sonia Nutt

My team had a great experience working with Little Dragon Media. We will certainly engage with Little Dragon Media for any additional projects in the future. Highly recommend!

- Carly Rooney

- 682A St-Clair West Toronto, ON M6C 1B1

- (647)-348-4995

- info@littledragon.ca

MOST POPULAR SERVICES

RECENT POSTS

GET MORE CLIENTS

Don't let your competitors take over. We'll help you climb to the top and get more clients.

- 682A St-Clair West Toronto, ON M6C1B1

- (647)-348-4995

- info@littledragon.ca

MOST POPULAR SERVICES

RECENT POSTS

GET MORE CLIENTS

Don't let your competitors take over. We'll help you climb to the top and get more clients.

Contact | Press Mentions | Privacy Policy | Terms of Service

© 2024 Little Dragon Media. All Rights Reserved.