GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

![]()

![]()

![]()

- January 5, 2025

-

Mohammed Saqib

Mohammed Saqib

One of the many challenges with an early stage business is securing funding to support its operations and growth. Merchant Growth and Journey Capital both provide startups with access to capital. In this review, we will compare both these companies based on factors such as fees, loan term, and customer’s feedback. Let’s start with this brief comparison table of these two lenders, before we dig deeper into their offerings:

| Feature | Merchant Growth vs Journey Capital |

|---|---|

| URL | www.MerchantGrowthCapital.ca www.journeycapital.ca |

| Loan Types | Merchant Growth: Term loans, merchant cash advances, lines of credit Journey Capital: Term loans, cash advances, lines of credit |

| Loan Amount Range | Merchant Growth: $5,000 – $800,000 Journey Capital: $10,000 – $300,000 |

| Repayment Flexibility | Merchant Growth: Flexible options; repayment tied to revenue for cash advances Journey Capital: Customized repayment plans based on cash flow cycles |

| Early Repayment | Merchant Growth: Allows early repayment with minimal penalties Journey Capital: Customized terms; repayment structured per project |

| Fee Structure | Merchant Growth: No hidden fees; rates vary by product and credit score Journey Capital: No hidden fees; good credit may qualify for discounts |

| Interest Rates | Merchant Growth: Moderate; higher for merchant cash advances Journey Capital: Competitive for term loans, potentially lower for good credit |

| Approval Speed | Merchant Growth: Fast approval Journey Capital: Longer application process |

| Credit Impact | Merchant Growth: Hard credit checks Journey Capital: No hard credit checks |

| Top-Up Option | Merchant Growth: Available after paying 33% of loan balance Journey Capital: Not specified |

| Customer Ratings | Merchant Growth: Google: 4.1/5 (100+ reviews); Trustpilot: 4.8/5 (531+ reviews) Journey Capital: Google: 4.7/5 (137+ reviews); Trustpilot: 4.9/5 (90+ reviews) |

| Customer Feedback Highlights | Merchant Growth: Fast approval, flexible repayment options Journey Capital: Personalized service, good rates for strong credit |

| Ideal for Startups With | Merchant Growth: Fluctuating revenue, need for quick funding Journey Capital: Strong credit, need for a structured repayment plan |

| Best For | Merchant Growth: Startups needing quick, flexible financing Journey Capital: Startups seeking personalized, competitive-rate financing |

☝ IMPORTANT 2025 TIPS:

➔ Exhausted and overwhelmed with debt? Consolidated Credit Canada may be able to offer you (a maximum of) 50% debt relief.

➔ Require financing but do not qualify for a loan from the bank? Check with Swoop for information on alternative lenders. (Expect additional costs and greater interest rates)

Overview of Merchant Growth and Journey Capital

Company name: Merchant Growth

URL: www.MerchantGrowthCapital.ca

Merchant Growth provides various business loans that are tailored to target the small business industry, and they include term loans, merchant cash advances, and lines of credit. The company is known for their fast approval and favorable repayment terms that are suitable for companies that require quick funds without the hassle of lengthy banking procedures.

Company name: Journey Capital

URL: https://www.journeycapital.ca/

Journey Capital also serves small and medium enterprises but with a focus on providing flexible, customized loan packages. Journey Capital’s business loans are flexible and can be utilized by companies with varying cash flow requirements. The company offers both term loans, cash advances, and lines of credit, often providing options not available through traditional financial institutions. Read our review of Journey Capital for more info.

For other lending options and a connection to alternative lenders, reach out to Swoop.

Loan Flexibility and Repayment Options

Merchant Growth:

Merchant Growth provides different types of loans such as fixed term loans, a flexible business line of credit, and cash advances that allow businesses to repay based on revenue fluctuation. This flexibility helps startups since the repayment can be related directly to business income, especially where the startup has unpredictable revenue such as in the case of seasonal businesses. They also allow early repayment with minimal penalties, which is a perk for companies looking to settle debts quickly and save on interest.

Journey Capital:

Journey Capital offers loans just like Merchant Growth but with a stronger emphasis on customized repayment structures. They review each business’s cash flow requirements separately and come up with payment structures that are consistent with the cash flow cycles of startups. However, Journey Capital may not offer the same level of flexibility in repayment amounts tied to revenue as Merchant Growth, which may be disadvantageous for startups with unpredictable cash flows. However, their loans can be structured to fit individual project requirements, going well with start-ups who are looking for a highly structured loan product.

Comparison Verdict:

Both lenders offer flexibility, but Merchant Growth’s cash advance product, with payments based on revenue, could be more advantageous for startups experiencing fluctuating income, while Journey Capital’s customized loans provide more stability for companies with steady cash flow.

Fee Structure and Interest Rates

Merchant Growth:

Merchant Growth’s fees are reasonable with interest rates depending on the loan product, the amount of loan, and the credit score. Merchant Growth also has no hidden fees, and their interest rates are relatively low compared to other bad credit business loans. Companies that have a good track record in cash flows may bargain for better rate charges. The fee structure for merchant cash advances can be higher due to the inherent risk for the lender, and it’s essential for borrowers to review these closely.

Journey Capital:

Journey Capital also has no hidden fees plus people on Trustpilot have mentioned that companies with a good credit history can get a loan at a good rate. The company tends to offer lower rates on term loans, cash advances may still carry higher costs. Journey Capital sometimes provides discounted rates for startups with recurring business.

Comparison Verdict:

While Merchant Growth may be a little pricier in fees, particularly for cash advances, they allow more freedom in repayment. Journey Capital might be more suitable for startups which would get a better rate based on the company’s eligibility and can commit to the full loan term. If your existing debts are out of control, consider debt relief options through Consolidated Credit Canada instead.

Customer Reviews and User Experience

Merchant Growth:

Google Reviews: 4.1/5 stars (100+ reviews)

Trustpilot Reviews: 4.8/5 stars (531+ reviews)

Merchant Growth has earned positive reviews from customers. The company is appreciated for its fast approval process and flexible repayment. Businesses appreciate the option to tie repayments to income, making it easier to manage cash flow. However, some of the users have complained that the interest rates are relatively high, and this may be a disadvantage for people looking for low cost borrowing. Customer support is frequently commended for being responsive and knowledgeable.

Journey Capital:

Google Reviews: 4.7/5 stars (137+ reviews)

Trustpilot Reviews: 4.9/5 stars (90+ reviews)

Journey Capital also has positive feedback from customers who appreciate the company’s flexibility regarding customization options and personalized service. They have a slightly more traditional approach to risk assessment, which some startups may find challenging if they lack a robust financial history. Nonetheless, companies embrace the fact that Journey Capital charges lower fees to clients with good credit histories and steady cash flows. Some of the users have complained that it takes longer to complete an application, but the customer support team is friendly and provides clear explanations about loan terms and conditions.

Comparison Verdict:

In terms of customer reviews, both companies perform well, though Merchant Growth has an edge in flexibility and speed of approval, while Journey Capital is favored for personalized service and competitive rates for qualified borrowers.

Loan Amounts and Terms

Merchant Growth:

Merchant Growth provides term financing and e-commerce financing from $5,000 to $800,000 for terms of 6 to 24 months based on the business’s financial history and loan type. Once the borrower pays about 33% of the original balance, they can avail top-up financing for investments in the business. This makes it ideal for startups requiring loan to make capital investments.

Journey Capital:

Journey Capital provides loan amounts ranging from $10,000 – $300,000, ideal for businesses that are looking for short-term financing. The company does not do any hard credit checks, ensuring that there is no negative impact on the credit score during the loan application and approval process.

Comparison Verdict:

Merchant Growth is optimal for startups requiring relatively higher amounts of loans for short-term needs or capital investment into the business. Whereas Journey Capital is better suited for short-term financing needs of startups.

☝ IMPORTANT 2025 TIPS:

➔ Exhausted and overwhelmed with debt? Consolidated Credit Canada may be able to offer you (a maximum of) 50% debt relief.

➔ Require financing but do not qualify for a loan from the bank? Check with Swoop for information on alternative lenders. (Expect additional costs and greater interest rates)

Final Verdict: Which is Better?

Choosing between Merchant Growth and Journey Capital will eventually depend on the unique needs of the borrower or their business. Merchant Growth’s flexibility in repayments, fast approval, and digital-first approach make it ideal for younger startups needing quick, manageable capital. Startups with inconsistent cash flows or limited credit history may find Merchant Growth’s offerings particularly advantageous.

Journey Capital, on the other hand, is suited for more established startups or those with strong credit, as they can benefit from potentially lower rates and longer-term, larger loan options. Their more personalized approach is appealing for startups that value a tailored financing plan and aren’t as pressed for immediate funding.

If neither option is right for you, consider using Swoop to connect with other lenders. But, remember, financing is not always the best solution. If you are unable to meet the payments on your existing debt, avoid applying for another loan. Instead, reach out to Consolidated Credit Canada for debt relief options.

Saqib is a Canadian business writer that holds a Master’s degree from Wilfrid Laurier University in Ottawa. He brings a strong foundation in business, accounting and finance to his work. He began his career three years ago as an investment analyst at a well-known financial firm, focusing on analyzing publicly-listed companies. Saqib employs fundamental analysis as a core part of his approach and has been featured in publications like Seeking Alpha, InvestorPlace, and Yahoo! Finance.

RECENT POSTS

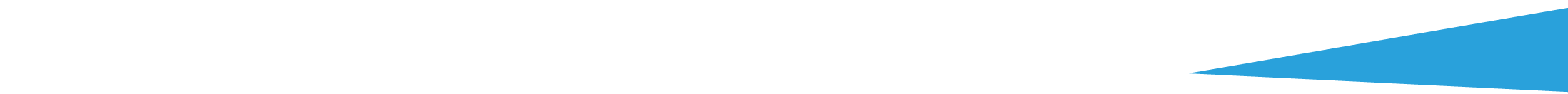

- SCAM ALERT: How a Fake Google Ads Inquiry Nearly Got Us (And How to Protect Yourself)

- Google My Business: 9 Tips to Ensure Your GMB profile Stands Out in the Map Pack

- 8 Outdated Logo Design Trends That Are Making Your Business Look Bad

- How We the North Became the Toronto Raptors’ Rallying Cry

- Is A Dedicated IP For SEO A Myth Or Reality? – 13 Experts Weigh In

Ready to chat about how Little Dragon Media can enhance your business?

Call us now at 647-348-4995 or

OUR AWARDS & CERTIFICATIONS

WHAT OUR CLIENTS ARE SAYING

Little Dragon Media's professionalism and commitment to delivering excellence are truly commendable. I highly recommend their services... Thank you for your stellar work!

- Delna Bharucha

Little Dragon Media worked on developing our logo and website. They did an absolutely AMAZING job on both projects. These guys ROCK and you won't be disappointed.

- Sonia Nutt

My team had a great experience working with Little Dragon Media. We will certainly engage with Little Dragon Media for any additional projects in the future. Highly recommend!

- Carly Rooney

- 682A St-Clair West Toronto, ON M6C 1B1

- (647)-348-4995

- info@littledragon.ca

MOST POPULAR SERVICES

RECENT POSTS

GET MORE CLIENTS

Don't let your competitors take over. We'll help you climb to the top and get more clients.

- 682A St-Clair West Toronto, ON M6C1B1

- (647)-348-4995

- info@littledragon.ca

MOST POPULAR SERVICES

RECENT POSTS

GET MORE CLIENTS

Don't let your competitors take over. We'll help you climb to the top and get more clients.

Contact | Press Mentions | Privacy Policy | Terms of Service

© 2024 Little Dragon Media. All Rights Reserved.