GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION

➥ AI & LLMO SEO- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION

➥ AI & LLMO SEO- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION

➥ AI & LLMO SEO- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

GOOGLE ADS MANAGEMENT

ALL SERVICES- GRAPHIC DESIGN & BRANDING

➥ WEBSITE DESIGN TORONTO

➥ TORONTO LOGO DESIGN

➥ BROCHURE GRAPHIC DESIGN

➥ INFOGRAPHIC DESIGN

➥ BUSINESS CARD DESIGN

➥ PACKAGE DESIGN TORONTO

➥ ILLUSTRATION DESIGN

➥ ADVERTISING POSTER DESIGN

➥ BRANDING STRATEGY & SERVICES- ➤ VIEW ALL SERVICES

WEB DEVELOPMENT & SUPPORT

➥ CUSTOM WEB DESIGN TORONTO

➥ ECOMMERCE WEBSITE DESIGN TORONTO

➥ WEBSITE MAINTENANCE SERVICES

➥ SHOPIFY WEBSITE DESIGN

➥ SHOPIFY EXPERTS TORONTO

➥ WORDPRESS DEVELOPMENT

➥ WORDPRESS MAINTENANCE- ➤ VIEW ALL SERVICES

WEBSITE MARKETING & CONTENT

➥ SEO PACKAGES TORONTO

➥ TORONTO SOCIAL MEDIA AGENCY

➥ CONTENT MARKETING TORONTO

➥ PPC MANAGEMENT TORONTO

➥ AFFILIATE MARKETING CANADA

➥ STRATEGIC CONSULTATION

➥ AI & LLMO SEO- ➤ VIEW ALL SERVICES

ABOUT

RESOURCES- LET’S CHAT

Questions? Call us at

647-348-4995

![]()

![]()

![]()

- February 3, 2026

-

Liam Hunt

In a recent survey conducted by TD and Maru Public Opinion, it was revealed that about 40% of small business owners do NOT have any form of business insurance in Canada. It’s even worse among our southern neighbours, where 44% of business owners forego insurance. Before we dive deeper into each company and their offerings, here’s a quick comparison table of some of the most popular business insurance companies in Canada:

| Insurance Company | Highlights |

| Zensurance (🏆 Best Overall in 2026) | Quick online interface, flexible business policies, starts at $19 per month. |

| Intact Insurance | Broad coverage options, customizable policies, strong nationwide presence. |

| Aviva Canada | Flexible coverage options, competitive pricing, wide range of business products. |

| The Co-operators | Cooperative business model, personalized service, local community focus. |

| Desjardins General Insurance (DGIG) | Comprehensive solutions, financial stability, wide range of options. |

| Northbridge Insurance | Specializes in commercial insurance, risk management, and loss prevention. |

| Economical Insurance | Customizable coverage, competitive pricing, and diverse insurance products. |

| Travelers Canada | Tailored policies, risk management tools, extensive industry expertise. |

As any experienced business owner will tell you, any small business will at some point face some form of legal action, property damage, or other liabilities that can financially cripple operations. Insurance serves as a protective shield, offering peace of mind and financial security in the event of disaster or unforeseen damages.

While business insurance isn’t legally required in most cases, provincial governments strongly recommend it, and for good reason…

Imagine, for instance, that a customer slips and falls on your property. If uninsured, the resulting lawsuit could cost you hundreds of thousands in damages and tens of thousands in legal fees. However, a small business with a $2,000-per-year general liability insurance policy would be spared these expenses. Most insurance policies have a $2 million coverage limit or more.

In short, small business insurance is a necessary lifeline for many Canadian entrepreneurs. Without it, most business owners wouldn’t be able to keep their company afloat during financial or legal crises.

8 Best Small Business Insurance Companies in Canada

Below are our eight top-rated insurance companies that specialize in insuring small businesses in Canada in consideration of diverse rating factors including affordability and coverage quality.

1. Zensurance (🏆Best Overall in 2026)

- Location: Offices in Toronto, ON and Vancouver, BC.

- Founded: 2016

- Available in: BC, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, PEI, Newfoundland, N.W.T., Yukon, Nunvaut.

- Pros: Built for entrepreneurs, Zensurance is disrupting the old-school business insurance market with its seamless online interface and flexible policies. This is the only type of insurance that operates entirely online, from quote to claim.

- Get a Free Quote (Check if You Qualify)

- Read Zensurance Review

2. Intact Insurance

- Location: Headquartered in Toronto, Ontario.

- Founded: 1809

- Available in: BC, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, PEI, Newfoundland, N.W.T., Yukon, Nunvaut.

- Pros: Known for its broad coverage options, including general liability, customizable policies, and a strong presence across Canada.

- Get a Quote

3. Aviva Canada

- Location: Based in Markham, Ontario.

- Founded: 1696

- Available in: BC, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, PEI, Newfoundland, N.W.T., Yukon, Nunvaut.

- Pros: Offers flexible coverage options, competitive pricing, and a range of business insurance products.

- Get a Quote

4. The Co-operators

- Location: Headquartered in Guelph, Ontario.

- Founded: 1945

- Available in: BC, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, PEI, Newfoundland, N.W.T., Yukon, Nunvaut.

- Pros: Known for its cooperative business model, personalized service, and a focus on supporting local communities.

- Get a Quote

5. Desjardins General Insurance (DGIG)

- Location: Based in Montreal, Quebec.

- Founded: 1944

- Available in: Quebec.

- Pros: Offers comprehensive insurance solutions, including general liability, and is known for its financial stability.

- Get a Quote

6. Northbridge Insurance

- Location: Headquartered in Toronto, Ontario.

- Founded: 1920

- Available in: BC, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, PEI, Newfoundland, N.W.T., Yukon, Nunvaut.

- Pros: Specializes in commercial insurance, including general liability, and provides risk management and loss prevention services.

- Get a Quote

7. Economical Insurance

- Location: Based in Waterloo, Ontario.

- Founded: 1871

- Available in: BC, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, PEI, Newfoundland, N.W.T., Yukon, Nunvaut.

- Pros: Offers a range of business insurance products, customizable coverage, and competitive pricing.

- Get a Quote

8. Travelers Canada

- Location: Headquartered in Toronto, Ontario.

- Founded: 1864

- Available in: BC, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, PEI, Newfoundland, N.W.T., Yukon, Nunvaut.

- Pros: Provides tailored insurance policies for small businesseses, risk management tools, and extensive industry expertise.

- Get a Quote

Note that the availability of these insurers and their offerings may vary depending on your location and specific business needs. Make sure to request quotes and compare policies from multiple insurers to find the best coverage and rates for your small business in Canada.

Finding the Right Insurance Provider

Choosing the right insurance provider is as important as the insurance itself. Look for providers with experience in your industry, transparent pricing, and positive customer reviews. Resources like the Canadian Federation of Independent Business (CFIB) can offer guidance.

Alternatively, you could contact one of our vetted and top-ranked Canadian small business insurance companies covered in this article. These companies are trusted by thousands of Canadian entrepreneurs due to their financial stability, reputation, claims handling process, diversity of coverage options, and their customer service track record. You may also want to check for insurance companies specifically located in your province, as provincial regulations in BC, Alberta, Ontario, Manitoba, Saskatchewan and other provinces and territories are set up differently and may affect pricing and coverage.

Key Types of Insurance for Small Businesses

For most Canadian entrepreneurs, general liability insurance (or “commercial liability insurance”) is the go-to option for protecting their business. However, there are several other options available to business owners should they choose for more specialized coverage:

- General Liability Insurance: Protects against claims of bodily injury, property damage, and advertising injury. It’s essential for all businesses, especially those interacting with clients or the public.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, it covers claims against businesses that provide professional and personal services, ideal for consultants, accountants, and lawyers.

- Property Insurance: Covers damage to business property and assets, including equipment, inventory, and furniture from fire, theft, or natural disasters.

- Business Interruption Insurance: Provides compensation for lost income and fixed expenses if your business operation is halted due to a covered loss like fire or flood.

- Cyber Liability Insurance: Important for businesses handling sensitive data, it protects against data breaches and cyber-attacks.

- Workers’ Compensation Insurance: Mandatory in most provinces, it covers medical costs and lost wages for employees injured at work.

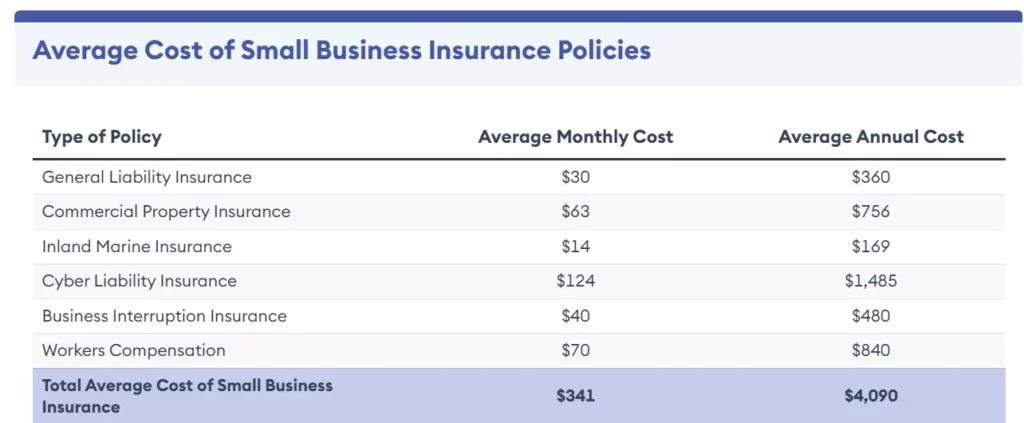

Factors Influencing Insurance Costs

The cost of insurance varies based on factors like business size, industry, location, and the types of coverage needed.

For instance, a tech startup might pay between $1,000 and $3,000 annually for general liability insurance, while a small retail business could pay around $500 to $2,000.

Note: Costs displayed are in USD (Source: Forbes Advisor)

The types of activities that your business undertakes will have an outsized influence on the costs associated with insuring the business. For example, construction companies have higher risks of accidents and workplace injuries than consulting firms. Therefore, insuring a construction company will come at a steeper price.

Other factors that influence the cost of small business insurance are the following:

- Type of Coverage: The specific insurance policies a business needs will significantly impact costs. Common types of coverage include general liability, property insurance, workers’ compensation, professional liability, and commercial auto insurance.

- Industry and Business Size: Different industries have varying levels of risk, and insurance costs can reflect these differences. Larger businesses often pay more for insurance due to their increased exposure to risk.

- Location: The location of the business can impact insurance costs. Areas prone to natural disasters, high crime rates, or litigation-heavy environments may lead to higher premiums.

- Claims History: A business’s claims history can affect insurance costs. Frequent or large claims can lead to higher premiums, as insurers view the business as a higher risk.

- Annual Revenue and Payroll: The size of a business, as measured by its annual revenue and the number of employees, can impact insurance costs. Larger businesses typically pay more for coverage.

- Coverage Limits and Deductibles: The limits of coverage and deductibles chosen by the business can affect costs. Higher coverage limits and lower deductibles generally result in higher premiums.

Small business owners should work closely with insurance professionals to assess their specific needs and risk profile, choose appropriate coverage, and find ways to manage costs effectively. Maintaining a good risk management strategy can also help businesses reduce insurance expenses over time.

Best Practices for Small Business Insurance

The best practices for finding the best small business insurance are fairly self-evident, but they bear mentioning:

- Assess Your Risks: Understand the specific risks associated with your business type.

- Shop Around: Get quotes from multiple providers to compare coverage and costs.

- Read the Fine Print: Understand what’s included and excluded in your policy.

- Review Annually: Your insurance needs may change as your business grows.

Don’t Let Small Business Insurance Be An Afterthought

Insurance is not just a regulatory requirement; it’s a strategic business decision. In today’s unpredictable business environment, having the right insurance coverage can mean the difference between a temporary setback and a catastrophic loss.

Canadian small business owners must take proactive steps to understand and invest in appropriate insurance coverage, ensuring their business’s longevity and stability. Consider contacting one of the trusted Canadian small business insurers listed above to protect your business today.

But liability insurance isn’t the only thing you need to protect and grow your business. Don’t forget to invest in your business’s future with a sound and forward-looking marketing strategy. To gain a competitive advantage, consider an SEO marketing strategy or content marketing strategy today.

Frequently Asked Questions about Business Insurance for Small Businesses

1. How Do I Get a Business Insurance Quote?

- You can easily get business insurance quotes online through providers like Zensurance, RBC Insurance, and Intact Insurance. For small business insurance Ontario or business insurance in BC, many insurance companies offer simple online tools for fast small business insurance quotes.

2. How Much is Business Liability Insurance for Small Businesses?

- Small business liability insurance costs depend on factors like location and coverage limits. In Ontario or Alberta, for instance, business liability insurance Ontario can be around $500 to $1,500 per year for small businesses, though it varies by provider.

3. Is Business Insurance Mandatory in Canada?

- While business insurance is not mandatory everywhere, specific types, like workers’ compensation and business car insurance, are required in certain provinces. This includes Ontario, British Columbia, Alberta, Quebec, Manitoba, Saskatchewan, Nova Scotia, New Brunswick, Newfoundland and Labrador, Prince Edward Island, Yukon, Northwest Territories, Nunavut.

4. What is Business Interruption Insurance?

- Business interruption insurance covers lost income if your business must temporarily close due to an insured event, like a fire or flood. This is crucial for small businesses relying on a steady cash flow to cover expenses during unexpected shutdowns.

5. How Can I Buy Business Insurance Online?

- Many providers offer business insurance online, including Zensurance, RBC Insurance and Intact Insurance. Online platforms provide quick quotes and customizable policies, making it easy to buy small business insurance.

6. What’s the Best Business Insurance for a Startup?

- Startup business insurance should focus on essentials like general liability and property coverage. Companies like Zensurance, Aviva, and Intact offer flexible policies to fit startups’ needs. Best small business insurance Canada options generally balance affordability with robust protection.

7. Do I Need Home-Based Business Insurance?

- Yes, home-based business insurance is recommended to cover business equipment, liability, and business interruption, which are often excluded from personal home insurance. This is especially relevant for small business insurance BC or small business insurance Alberta.

8. Can I Get Business Insurance for a Sole Proprietor?

- Absolutely. Sole proprietor business insurance offers tailored coverage options, like general liability and professional liability, that protect against risks unique to your industry.

9. What’s the Difference Between Business Liability Insurance and General Liability Insurance?

- Business liability insurance is a broad term that includes various coverages like general liability insurance and professional liability insurance. General liability covers physical damages and injuries, whereas professional liability is for errors or negligence in service-based businesses.

10. How Do I Choose the Best Business Insurance for My Small Business?

- Finding the best small business insurance depends on your specific needs. Compare business insurance quotes from reputable providers, look at policy options and customer reviews, and choose coverage that addresses your business risks.

11. Can I Get a Small Business Insurance Policy That Includes Multiple Types of Coverage?

- Yes, many providers offer customizable small business insurance policies that bundle general liability, property, and business interruption insurance, so you only pay for the coverage you need.

12. Is There Business Insurance Specifically for Consultants?

- Yes, business insurance for consultants typically includes professional liability (errors and omissions) and general liability insurance to cover service-based risks and liability for bodily injury or property damage.

13. How Can I Find the Best Small Business Insurance in Ontario?

- For small business insurance Ontario, consider providers like Intact, Aviva, and Co-operators, known for flexible policies and competitive rates. Compare quotes, ask about customizations, and check for positive reviews to find the best small business insurance Ontario offers.

14. What About Business Insurance for High-Risk Industries Like Food Services or Construction?

- High-risk industries should prioritize business hazard insurance and general liability, covering injuries and property damage. Food business insurance often includes product liability, and construction businesses may need more comprehensive coverage.

15. Where Can I Buy Business Insurance in Alberta?

- Many national providers, like Economical and Travelers Canada, offer business insurance in Alberta. They have offices in Calgary, Edmonton, Medicine Hat, Lethbridge, Red Deer and all major Alberta cities and towns. You can also use brokers for tailored policies that meet Alberta’s unique business insurance needs.

16. How Can I Find Affordable Small Business Health Insurance?

- Some insurance providers offer small business health insurance plans. These plans can be customized based on the size and needs of your business and employees. RBC and Desjardins are popular options for group health insurance.

Liam Hunt, M.A., is a writer and digital marketing specialist whose writing has appeared in the Vancouver Sun, Asia Times, and US News and World Report.

RECENT POSTS

- 7 SEO Tips for Insurance Firms (2026 Update)

- Top SEO Tips In 2026 For Restaurants – 9 Experts Weigh In

- Top 8 Small Business Insurance Providers in Canada (2026)

- Merchant Growth vs Journey Capital: Which is Better for Startup Business Loans in 2026?

- PolicyMe – Legit Canadian Insurance Policy? Let’s Review…

Ready to chat about how Little Dragon Media can enhance your business?

Call us now at 647-348-4995 or

OUR AWARDS & CERTIFICATIONS

WHAT OUR CLIENTS ARE SAYING

Little Dragon Media's professionalism and commitment to delivering excellence are truly commendable. I highly recommend their services... Thank you for your stellar work!

- Delna Bharucha

Little Dragon Media worked on developing our logo and website. They did an absolutely AMAZING job on both projects. These guys ROCK and you won't be disappointed.

- Sonia Nutt

My team had a great experience working with Little Dragon Media. We will certainly engage with Little Dragon Media for any additional projects in the future. Highly recommend!

- Carly Rooney

- 682A St-Clair West Toronto, ON M6C 1B1

- (647)-348-4995

- info@littledragon.ca

MOST POPULAR SERVICES

RECENT POSTS

GET MORE CLIENTS

Don't let your competitors take over. We'll help you climb to the top and get more clients.

- 682A St-Clair West Toronto, ON M6C1B1

- (647)-348-4995

- info@littledragon.ca

MOST POPULAR SERVICES

RECENT POSTS

GET MORE CLIENTS

Don't let your competitors take over. We'll help you climb to the top and get more clients.

Contact | Press Mentions | Privacy Policy | Terms of Service

© 2024 Little Dragon Media. All Rights Reserved.

Pingback: General Liability Insurance Cost: What Small Businesses Pay

Pingback: Small Business Insurance: Protect Your Company Today